January 2010 Shows Improvement over January 2009

January 2010 Shows Improvement over January 2009 Single Family Residential closings for January 2010 totaled 2608 which is a 17% increase over January 2009. Additionally, townhomes and condos saw added 594 closings which respresent a 35% increase over the same period in 2009.

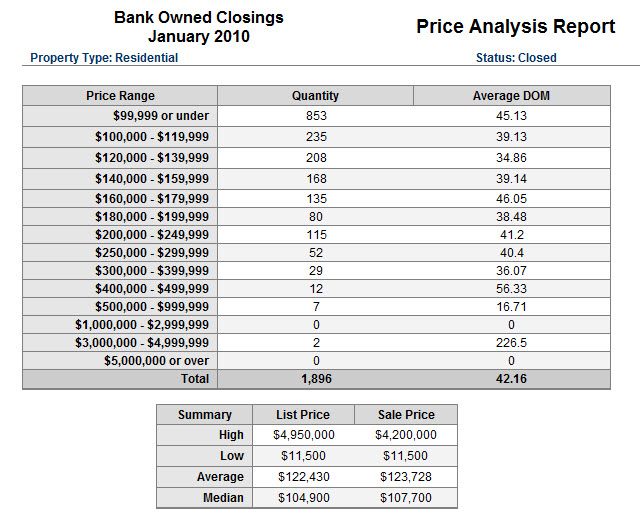

The availability of bank-owned listings has declines to under 1900 available listings in the Greater Las Vegas area. Short sale listings now are at account for another 4900 properties while traditional listings total nearly 4500 . REO closings in January accounted for 59% of all single family residential (SFR) sales. Short sales transactions made up 21% of January sales and Traditional sellers accounted for 20% of all residential sales in January.

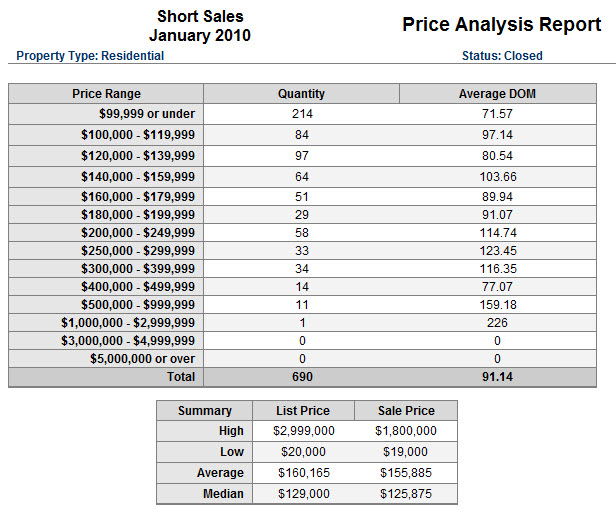

Let’s compare the price breakdown of all bank-owned properties in the Greater Las Vegas Area that closed in January 2010 with the Classic or Traditional Closings as well as the increasing Short Sales. First here is the price analysis of bank-owned closings:

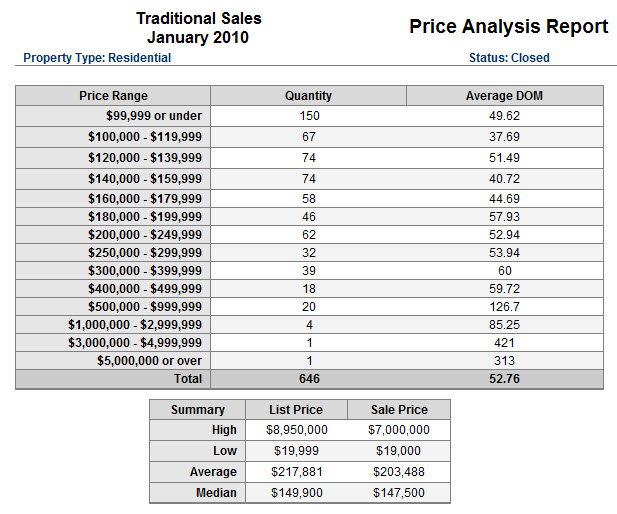

By contrast here is the price analysis of the Classic or Traditional Closings. What stands out here is the sales price range of traditional sales and the higher average and median closing prices.

January closings sold according to the following terms:

- Cash 45% with an average sales price of $124,763

- Conv 21% with an average sales price of $191,248

- FHA 27% with an average sales price of $147,947

- VA 5% with an average sales price of $174,429

Cash sales increased measurably during January as both conventional and FHA mortgages seem to tighten their credit and underwriting standards.

For additional information on statistics, absorption rates, or getting ready for you listing presentation, check out;

Agent Login

Agent Login

is a registered service mark of the Prudential Insurance Company of America. Equal Housing Opportunity.

is a registered service mark of the Prudential Insurance Company of America. Equal Housing Opportunity.